Harvesting Harmony. Powering Portfolios.

Are you quantifying your renewable portfolio diversity?

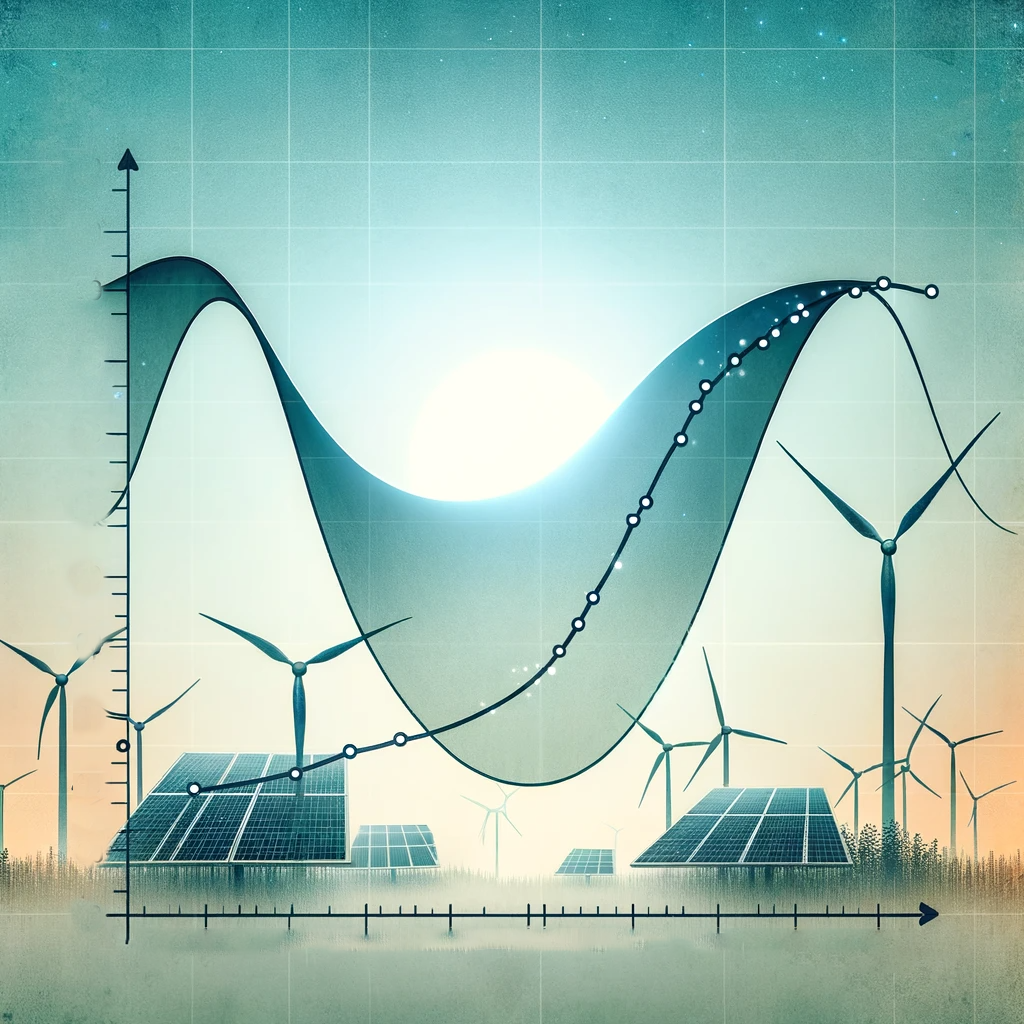

In the realm of renewable energy investments, accurately gauging annual production probabilities for an entire portfolio can be a complex endeavor. Many investors and asset owners instead default to a straightforward method of aggregating the probabilities of exceedance of individual projects (P75, P90, etc.) This is a mistake, however, and results in an overestimation of portfolio uncertainty! The key insight, often missed, is that production variability between projects is not perfectly correlated. For example, a low production year for a wind farm in Iowa may be offset by a high production year for a solar farm in California. By accounting for the interplay of these project-level uncertainties, it is possible to significantly narrow the overall uncertainty in portfolio production. In short, the portfolio as a whole is more than just the sum of its parts!

This is where our Asset Diversity Factor (ADF) plays a transformative role, turning production variability into an asset rather than a liability.

It’s not just resource variability

Resource uncertainty stands as a prime illustration of how energy production across diverse sites can complement and balance each other. Yet, this is just the tip of the proverbial blade. In reality, every category of uncertainty in both pre-construction and operational energy production estimates carries potential for offsetting effects. Take, for instance, curtailment losses: an offshore wind farm in Europe and another in the U.S. are likely to experience these losses independently, with minimal correlation. Similarly, the availability losses faced by a Vestas turbine operating in Nevada’s arid desert contrast sharply with those of a GE turbine enduring the severe winters of Northern Quebec.

The interplay of these uncertainties is far from random; they are interconnected in a complex web of quantifiable correlations that influences the overall portfolio. It’s this intricate network of linkages that Veer’s ADF product skillfully unravels, providing a nuanced, holistic view of portfolio performance in the face of diverse inter-asset interactions.

Quantifying the Benefit

By harnessing the power of comprehensive renewable asset data, precise meteorological insights, and the cutting edge of data science—including Monte Carlo simulations and Markov chains—alongside contemporary machine learning algorithms, our Asset Diversity Factor delivers a robust and quantitative evaluation of your portfolio’s diversity. Our approach goes beyond merely measuring the overall reduction in uncertainty and exceedance probabilities across your portfolio; we meticulously dissect the individual contributions of each project. This granular analysis empowers you with the knowledge to discern the precise impact that integrating a new asset will have on your renewable energy fleet.